Startups and SMEs need to manage their funds smartly for proper growth. Good bookkeeping can gear them to better profit and a positive cash flow.

With so many other things to handle, bookkeeping is best assigned to a virtual bookkeeping assistant. They will help you keep your accounts and business transactions accurate and up to date. All of which can be readily retrieved for reporting and evaluation.

Get the best bookkeeping service for startups at a lower cost with Magic Virtual Assistant. Match with the most suitable VA with the data entry skills and tools you need. Check out all you need to know before hiring a bookkeeping virtual assistant for your business.

What Are Bookkeeping Services?

Bookkeeping services refer to keeping a record of a business’ daily financial affairs in organized accounts. This includes all transactions, operations, and other events of a business.

With traditional bookkeeping services, a bookkeeper will record transactions in accounting books. A virtual bookkeeper also updates business records digitally. Business collaboration tools have paved the way for virtual assistants to provide a low-cost but effective bookkeeping service for startups.

Some of the virtual assistant bookkeeping services you can get include:

- Data entry jobs

- Tax services

- Accounts payable jobs

- Accounts receivable jobs

- Bank reconciliation jobs

- Corporate payroll services

How Can a Bookkeeping Assistant Help Manage Your Finances

The competence of a business is seen in how accurate and systematic its records are. A virtual assistant bookkeeper will maintain ledgers and track all the dealings of your business. Here are their duties and responsibilities to ensure that you can soundly manage your cash flow:

1. Financial Records and Statements

Accurate fiscal reports are crucial for business growth. They let investors, banks, and market analysts understand the financial health and earning potential of your business. Let a bookkeeping assistant handle your journal entries for precise financial reports.

These include but are not limited to:

- Balance sheets

- Income statements

- Statements of cash flows

- Bank reconciliation statements

A virtual bookkeeping assistant will keep your books up to date and prepare the reports you need to let you see if your plans are befitting your business or not.

2. Invoice and Prompt Payments

Bills and invoices should be paid on time to avoid surcharges and other fees. This also ensures any service subscriptions you use remain active. On top of that, account receivables are the lifeblood of your cash flow so it must always be in order.

A bookkeeper assistant will keep you updated on which of your clients owe you money and how much. This way, your accounts are closely monitored and can be endorsed to the collection department. They can also remind you to pay your bills such as:

- Office equipment and/or software

- Bank fees and interest

- Rent and utilities

- Insurance

- Membership dues

- Commissions and fees

- Advertising

- Subscriptions

- Legal fees

Another bookkeeping service for startups in the retail, finance, or manufacturing sectors is credit control. This is often taken up by the company’s risk management committee. Your VA can help them monitor and manage it to cut down the losses brought on by poor loans.

3. Tax Preparation and Management

No one looks forward to computing and paying taxes. Many businesses dread this time of the year. Some even remain clueless about how much they have to pay until the last moment.

A bookkeeping virtual assistant helps you take care of your business taxes including paying them quarterly or annually. They can accurately compute your taxes and other accounts so you don’t waste money or time with it.

Read More on This Topic: The Bookkeeping Services List You Need for Financial Efficiency

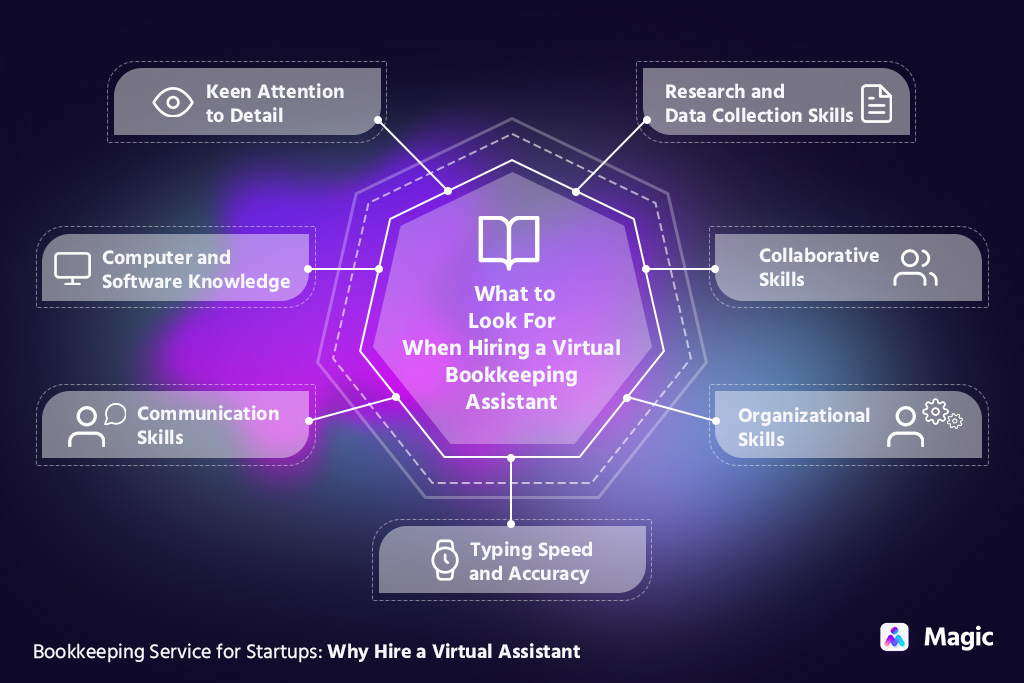

What to Look For When Hiring a Virtual Bookkeeping Assistant

A bookkeeping assistant with good data entry skills requires no or minimal supervision. They can provide an accurate and structured bookkeeping service for startups at a low cost. To help you find the right VA for your business, here are some qualities you should look for:

1. Keen Attention to Detail

A high level of attention to detail is one of the most vital skills that a virtual assistant bookkeeper should have. It allows them to focus on a certain task for quick and accurate results. This way, they can avoid errors so they don’t waste time redoing things. Instead, they will have more time for data checking and other tasks.

2. Computer and Software Knowledge

A bookkeeper assistant in charge of data entry needs to know how to expertly use the right equipment and tools. They should be able to enter financial, statistical, and coded information using calculators, scanners, computers, and the like.

They must be able to use record management software such as:

- Quickbooks

- Xero

- Excel

- Word processors

- Databases

As a small business owner, you can give a data entry skills test as part of the hiring process. This will let you see if applicants have the software proficiency you’re looking for in a VA.

3. Communication Skills

Accurate recording of financial transactions also includes using correct grammar and spelling. Written communication skills are vital for a virtual assistant bookkeeper since they encode data.

As part of your business, they’ll be exchanging information with other team members, managers, and clients. There are also times when they need to discuss tax filing details or payroll. To do this, they’ll need to be effective communicators whether on the phone or in writing.

4. Typing Speed and Accuracy

The basic data entry speed is 40 words per minute (WPM) while the average is 50 WPM. A good typing speed per minute is around 70 WMP which is what a bookkeeping virtual assistant should have.

With a good typing speed per minute, a data entry VA must be good with a wide range of input tools. They should strive to have 92% typing accuracy.

Data entry experience allows a virtual assistant to build on good typing speed and proficiency. They should aim for fast but accurate encoding since errors can waste money and time.

5. Research And Data Collection Skills

There will always be research and data collection involved when doing data entry tasks. Whether it’s for monthly or yearly fiscal reports, these skills allow your virtual bookkeeping assistant to create better outputs.

Coupled with data processing skills, a bookkeeping assistant should be able to handle credit control and bank reconciliations well.

6. Collaborative Skills

Whether in an office or remote work setup, a virtual assistant bookkeeper will always be part of a team. Team-oriented VAs can play a part in having great working conditions with traits such as:

- Communicating clearly with the team

- Actively listening to people

- Being accountable for mistakes

- Taking into account the perspective of others

- Working out and solving problems with ease

7. Organizational Skills

Time management often goes hand-in-hand with organization. This combination is the most efficient way to perform bookkeeping tasks. For instance, data entry requires inputting a lot of business records as quickly and as accurately as possible.

Another attribute of this skill combo is calendar management. A VA should be up to date with your accounting books. This also includes knowing exactly when a report or payment should be made. This way, deadlines are met and things like additional expenses can be avoided.

With these skills, a bookkeeping assistant can plan, prioritize, and perform daily tasks better. Plus, having these enable them to quickly sort, batch, and archive files for better record keeping.

Bring In Magic For Your Bookkeeping Tasks

Get a low-cost and sound bookkeeping service for your business. Magic will match you with the right bookkeeping assistant based on your needs. We source and screen our talent pool so you don’t have to worry about the hiring process.

Still unsure if you need bookkeeping services for your business? Discover how a Magic Virtual Assistant will help manage your accounting books. It’s time to bring in a virtual bookkeeping assistant if your business has one or more of the conditions below:

Too Much Time Spent On Accounting

Accounting requires detailed and proper records of daily business dealings. Doing it will eat up your time and keep you from other more crucial duties as a business owner. Getting a VA to focus on your bookkeeping needs will keep your business organized and even foster growth prospects.

Your Taxes Are Complex

Having many clients and income streams combined with computing and forms to do makes taxes a very complex task. For instance, you might feel overwhelmed with what deductions to put in for your income stream.

Free yourself from this headache by getting the services of a bookkeeping assistant. They’ll bring you up to date with all your payroll and tax declarations

Your Business Is Growing

SME and startup owners may want to handle things at the start. They feel that they can’t spare the money to pay for outsourced bookkeeping services. However, it’s wise to get one once you’re growing your business.

Hire a virtual bookkeeping assistant to keep your fiscal records in order. This way, a certified public accountant (CPA) can do more complex tasks at a quicker pace. You can scale up or down based on your needs later on.

Get started with the most suitable bookkeeping service for startups with Magic! All in all, we aim to make collaboration and workflows easy for you and your virtual assistant. This also includes the hiring process. Check out our hiring guide and book a call with us now!