Goals provide clear objectives to aim for. The more attentive you are in setting business goals, the better you can strive to achieve what you want without wasting resources.

By lining up short and long-term goals, you can drive your business to success on your own terms. On top of that, your key business metrics will help you measure your growth with accuracy and objectivity.

Have you clearly set your business goals for this year or the next decade? Here are a few things you should know about goal setting in business.

What Are Business Goals?

Business goals are predetermined targets to be reached in a specific time frame, often split into short-term and long-term goals. They are crucial in knowing your priorities and pushing your business on the right path.

Short-term business goals are often the stepping stones toward the bigger plans of a company. They’re meant to be achieved in the near future; from within a matter of hours to a year or so. It is common to lay down many short-term goals to make long-term goals more feasible.

Long-term business goals are aimed further into the future, usually within ten years. Because of this, they are often set as the company’s vision or mission statements.

What Are the Types of Goals in Business?

Setting business goals differ depending on what you want to achieve. There are 3 main types of business goals that line up with the organizational level at which they are made:

Strategic Goals

Strategic goals are specific financial and non-financial pursuits for a business’s long-term vision. They are usually set by higher-level managers such as a board of directors. These business goals are then handed down to the executives and lower-level managers.

Tactical Goals

Once strategic goals are set, middle managers break them down into tactical goals. They are more actionable business goals that outline the steps needed to be done by a specific department or team. They can also be set to address a certain business problem.

Operational Goals

Operational goals are time-bound targets or key performance indicators (KPIs). They are broken down into daily tasks and requirements to run a business. These are used to keep track of employees’ functions in a business’s growth.

Why Is Goal Setting in Business Important?

Business goals provide a clear path for your company to grow, improve, and become more profitable. They influence not just your business’s future, but its day-to-day operations. Below are four benefits of setting business goals:

1. It outlines your success

When you set clearly defined goals for your business, you can map out how to reach them. Business goals connect your work to success by informing you what you need to do, when you need to complete them, and the tactics you can use to reach them. This makes decision-making easier, giving you more time and energy to focus on your actions.

2. It keeps your teams aligned

Setting goals for a business allows each team to define its work. For example, a business goal to drive more profit might guide the marketing team to enforce a new outreach strategy while the sales team may increase their quota.

It builds trust in leadership and draws up strategic priorities. This can be further broken down to an individual level that keeps each team member accountable for the actions required to reach a common goal.

3. It motivates you

Your business goals are the reason why you’re working. Goal setting is a widely effective and practical theory of motivation. With a goal in place, you can also get over mental blocks more easily since you know your priorities. They can also help you monitor your work.

4. It helps track your growth

Goals are a great way to keep track of your business growth. Since you know what you want to achieve, you can look at the work you’re doing toward reaching that goal. You can also find out which actions are paying off based on how easily or quickly they push you to desired results.

Tips on How to Set Business Goals

Business goals give you a road map for your company’s future. That said, they need to be carefully thought out to ensure that you don’t make the wrong turns and burn up time or money. Keep in mind these practices to effectively hit your targets on time and within the budget:

1. Ask questions

Raise questions and concerns before you set your objectives, especially goals when starting a new business. This can help create clear and realistic targets for your business.

Some questions you can ask yourself about your business are:

- Why are you doing this?

- Why are you the people to do it?

- What are you selling beyond the utility of the product or service?

- How can you add more value?

- What’s your greatest strength?

- What weakness might get in the way if you don’t address it?

- What does success look like, today, this year, next year, and five years from now?

- What matters most right now?

2. Use a goal-setting framework

A goal-setting framework guides you in making clear, feasible, and measurable goals. It helps you avoid pitfalls and weak points while maximizing your strengths.

You can use goal-setting frameworks such as:

- SMART (Specific, Measurable, Attainable, Relevant, and Time-Bound) – A method that provides well-defined goals geared toward success over a specified time.

- BHAG (Big Hairy Audacious Goal) – A guide used for long-term business goals to lead employees to a common cause.

- MBO (Management by Objectives) – A process that first defines top business priorities as short-term business goals to define employees’ objectives.

- OKR (Objectives and Key Results) – A protocol that aligns and engages employees to focus their efforts on what truly matters.

3. Build a good support system

Having a solid team behind you can greatly affect how quickly and effectively you can reach business goals. The right employees can apply their skills and experience to take the steps needed to achieve goals, or to offer different perspectives on business.

A good support system can include your in-house staff, business partners, and even on-demand remote workers. A virtual assistant can be a helpful addition to your team, especially for hard-to-fill positions or fluctuating workloads.

4. Break them down by quarter

Make sure that you divide your business goals for each quarter allowing you to focus on different priorities in a year. A quarterly plan also helps you measure your achievements. On top of that, it allows you to adjust or improve your plans for the next quarter accordingly.

Look back on your previous milestones when setting business goals for a new quarter. These will inform your plans whether it’s carrying over a goal or outlining a new one. This way, you can keep your eye on the end goal of your business.

5. Be flexible

While goals allow you to foresee the work that needs to be done, not everything will happen exactly as planned. So, you should be able to adjust to sudden changes and improve your business plans as necessary.

6. Always measure your growth

Keep records of your progress in meeting business goals and make sure everyone in your team has access to these. Doing weekly and/or monthly check-ins can also provide insight into what you have achieved so far and what needs to improve or receive more attention.

This will also help in building programs and projects each department can work on. Lastly, it inspires workers since big or small wins can be seen and celebrated with everyone.

Key Business Metrics You Should Include in Business Goals

Running a business demands objectivity and precision based on data. Some key metrics to measure business performance cover departments such as sales, marketing, and finance.

Keeping track of key business metrics will give you context into which targets were reached or missed, what needs to be improved, new goals, and recurring trends. Below are some of the key metrics to measure business growth:

1. Sales Metrics

Sales metrics measure and assess your sales-related performance over a given time. Here are key metrics to track in sales:

1.1 Sales Growth Rate

Sales growth rate measures your ability to increase income from sales over a fixed period of time. This metric gives a broad picture of your growth instead of focusing on a certain business area. Here’s how to compute it:

If your sales growth rate is lower than in previous periods, this can indicate that your sales team needs to rethink its strategy. There are many ways to boost your sales growth without restructuring your entire business model such as:

- Support your sales team with training.

- Promote other products to existing customers.

- Focus on building strong customer relationships.

- Don’t neglect existing customers when seeking new ones.

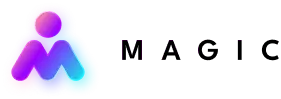

1.2 Customer Churn Rate

Customer churn rate refers to the number of customers that stop buying from you over a given time. This is commonly applied to subscription models where it takes note of subscribers that cancel or don’t renew their accounts.

Measuring your churn rate will help you assess the effectiveness of your sales and marketing efforts and your overall customer satisfaction. Here’s how to compute it:

Having a high customer churn rate may call for a different approach in strategy. Some ways you can reduce customer churn include:

- Always ask for feedback.

- Ensure consistent, excellent customer service.

- Create an online community.

- Focus on your most profitable customers.

2. Marketing Metrics

Key business metrics in marketing inform you of which mix of marketing channels and tactics works best for your business. Here are key metrics to track in marketing:

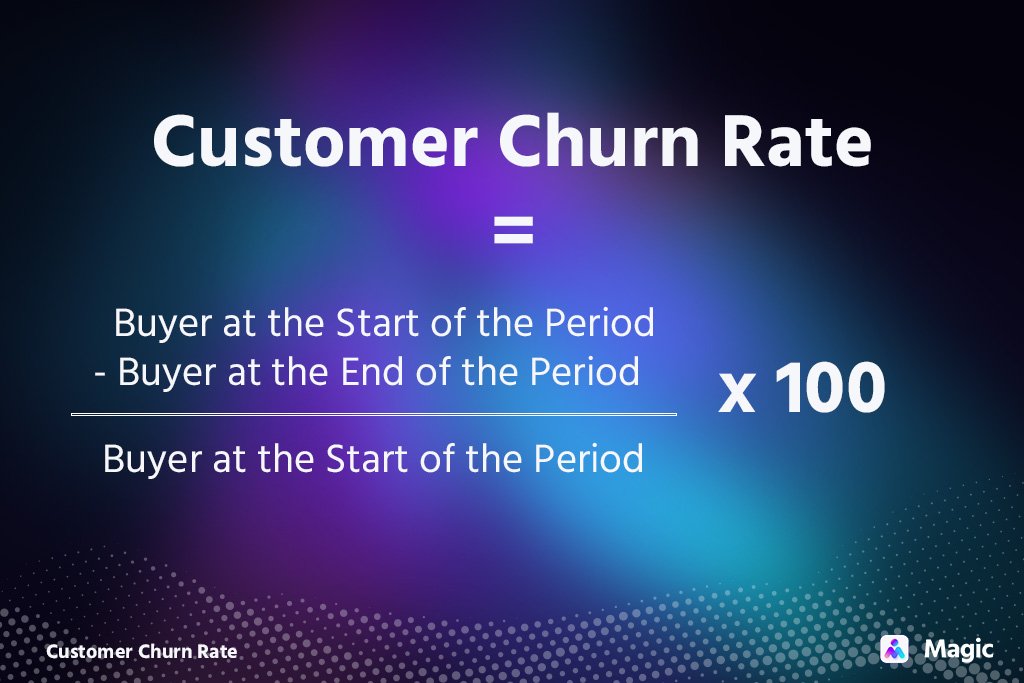

2.1 Return on Ad Spend

Return on Ad Spend (ROAS) measures the revenue your business generates for each dollar spent on advertising. A high ROAS means that your ads are effective and that more prospects can relate to your ad message. Here’s how to compute it:

If you are seeing low ROAS for your business, consider taking the following steps:

- Optimize page load speed.

- Segment your audience based on attributes like geolocation, the device used, or job title.

- Use negative keywords to put more emphasis on specific keywords that matter.

- Ensure accurate conversion tracking by comparing offline conversion data with social media metrics, such as Facebook clicks.

2.2 Customer Acquisition Cost

Customer acquisition cost (CAC) refers to the amount of money you spend to convert leads into buyers. It shows your profitability by comparing the cost of attracting customers (e.g. marketing, sales personnel, advertising) to the number of customers you actually gained.

Here’s how to compute it:

A low CAC means that you are spending money efficiently and seeing higher returns. To ensure low CACs, try optimizing your content with these customer acquisition techniques:

- Content marketing – provides unique and relevant content to catch your audience’s attention.

- Email marketing – keeps you connected with your audience, whether by sending a promotional email or a happy birthday email.

- Search marketing – can be classified into organic and paid; it optimizes your content to make it easily found and accessible to your target audience.

- Social media marketing – helps raise brand awareness and promote your content published on other platforms.

3. Finance Metrics

Finance metrics reflect the financial health of your business. It involves factors like revenue, cash flow, accounts receivables, assets, and liabilities, among others. Here are key business metrics to track in finance:

3.1 Gross Profit Margin

Gross profit margin measures how much your business earned minus operating costs, labor, materials, and other direct business expenses. For startups and small businesses, profit margins may generally be lower as brand-new operations can take a while to show efficacy. As you grow, your revenue should ideally be able to cover your production costs.

Here’s how to compute it:

Take note of these tips to boost your gross profit margin:

- Determine the right pricing for your products.

- Focus on your most profitable product mix.

- Automate repetitive tasks to reduce overhead costs.

- Manage your inventory to make data-driven decisions.

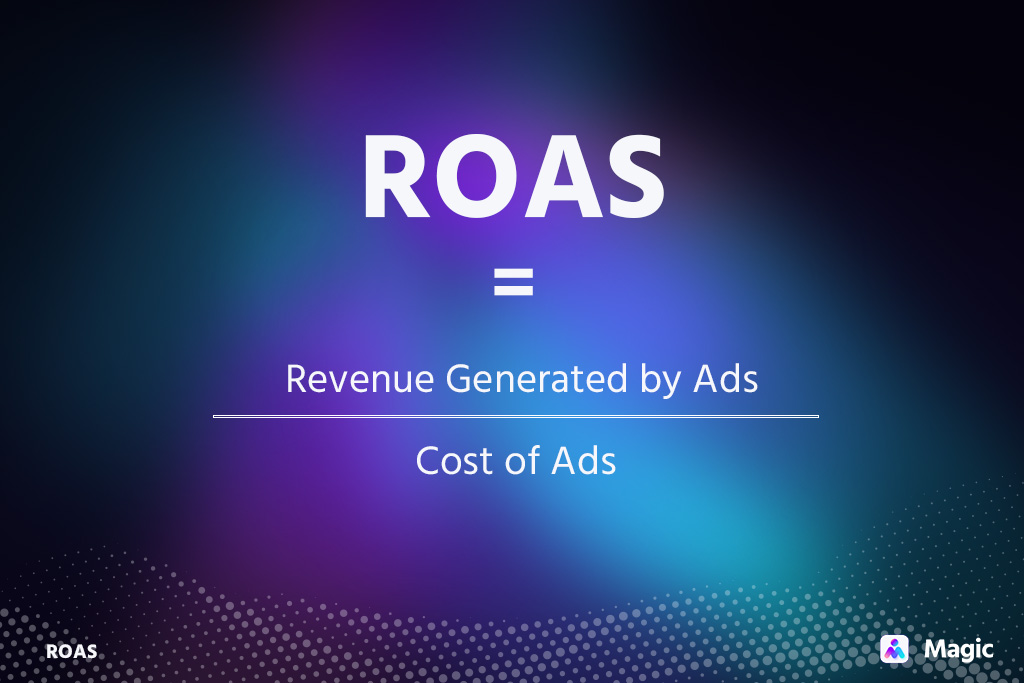

3.2 Working Capital

Working capital computes a business’s ability to pay its liabilities with its assets within a period of time.

Assets include checking and savings accounts, accounts receivable, stocks, mutual funds, and other resources that can be converted into cash. Meanwhile, liabilities refer to all the expenses a company is expected to pay within a business cycle.

A positive working capital indicates robust financial health, operational efficiency, and capacity to clear bills within a year. Here’s how to compute it:

Some techniques you can employ to manage working capital are:

- Implement thorough credit checks to reduce debt.

- Consider converting to electronic payables and receivables.

- Compare risk with profitability to calculate the appropriate cash balance.

- Prepare cash budgets to project cash flows.

Why It’s Important to Track Key Business Metrics

You can’t rely solely on word of mouth or gut feeling to know how your business is doing. Having data about your business growth lets you make more informed decisions. By tracking the small business performance metrics discussed above, you can:

1. Identify problems before they happen

There may be recurring patterns and trends within your business operations and overall industry landscape that are hindering your growth. With business metrics, you can make accurate forecasts and informed decisions to avoid oversights.

2. Conduct competitive analysis

Tracking business metrics helps you determine whether your company is performing well or underperforming based on your industry’s competitive landscape.

3. Quantify feedback

Performance indicators expressed in terms like “good quality” or “bad quality” are vague and subjective. Looking at business metrics will help you transform feedback and operational performance into measurable numbers. Remember, what is measured can be managed.

4. Get practical insights

Business metrics help indicate whether or not your business is reaching its goals. It will allow you to accurately adjust strategies and processes that will produce more sustainable results.

Reach Your Business Goals with Magic!

Are you setting your business up for success? Add Magic to your work and we’ll help you from setting business goals to hitting them.

There’s only so much one person can do within a day, even more so for a small business owner. Scale talent and boost your productivity at a low cost by hiring a Magic Virtual Assistant. This way, you can stay on top of your work without compromising your core duties.

Magic Virtual Assistants can fill in a roster of business roles to get things done for you. They will support you in doing all the tasks toward reaching your goals. Keep track of your growth by tasking your VA to measure your key business metrics in any department such as:

- Administration – data entry, email management, appointment scheduling, online research, file management

- Sales – CRM database management, data scrubbing, lead generation, lead qualification

- Customer support – manage queries through email, chat, or phone support

- Bookkeeping – create cash flow statements, organize corporate documents, update credit card statements, reconcile transactions

Reach business goals on time by delegating tasks to a Magic Virtual Assistant. Just book a call with us and let’s talk about your goals. Magic will match you with a virtual assistant based on what you need within 72 hours!