Delegating payroll to an assistant is a great way to save time on an essential task, while making sure your business stays compliant with pay and tax regulations.

An assistant can double-check time sheets and deductions, calculate gross and net pay, and handle payouts. They can also record all this and summarize it in regular reports for easy review.

This article includes instructions for delegating pay calculation, payouts, record-keeping, and tax payments. You can assign one or more of these to an assistant, according to the needs of your business.

Set Your Assistant Up for Payroll

First, give your assistant the information and permissions they’ll need to carry out payroll. This includes access to employee timesheets and pay rates or salaries, as well as permission to send payments (if you are delegating this to them).

Online Accounting Platforms

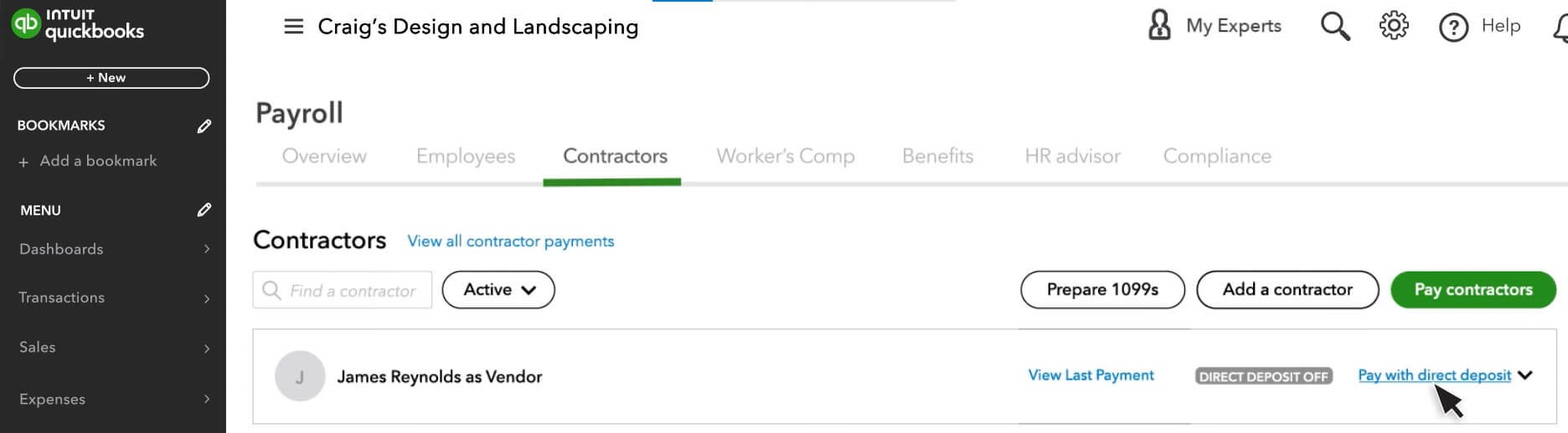

Online accounting platforms, such as Quickbooks and Xero, have built-in payroll functions, which cover timesheets, salaries, and payouts.

If you’re using one of these platforms, you can add your assistant as a user and they will have all they need to work on payroll. You can manage their roles and permissions to limit their access to other financial records of your business.

If you use payment methods not linked to this platform—for paying contractors, for example—you’ll need to give your assistant permission to use these as well. You can grant access using a password manager with multifactor authentication enabled.

Manual Payroll

If you’re not using online accounting software, make sure your assistant has access to the following:

- Employee information: Timesheets, tax information, hourly rates or salary; invoices for contractors.

- Payment methods: permission to make payments through your online banking, digital wallets, or other virtual payment methods.

Time-Tracking Tools

To calculate hours for each employee, your assistant will also need access to employee time sheets as well as records of time off.

If you use a centralized time-tracking system, just grant your assistant access, and they’ll have the information they need.

Alternatively, your assistant can coordinate with your HR or Admin teams to get the necessary information. Assign a specific point person to provide them with this information each pay period.

Pay Calculation

Your assistant can calculate payouts for each payroll period, so that all you have to do is review and approve the payouts.

Timesheets

Your assistant will review the hours logged for each pay period, using available timesheets or logs from the time-tracking programs you use.

They will tally the total hours for each employee and contractor. This includes accounting for:

- Time off (paid and unpaid)

- Overtime and shift differentials

- Holiday pay

- Bonuses or commissions

Calculating Gross Pay

Your assistant will then calculate gross pay based on each employee’s rates or salary, accounting for the factors mentioned above.

Taxes and Deductions

Your assistant will tally appropriate deductions for each employee.

- Federal income tax

- State and local taxes (if applicable)

- Social Security and Medicare (FICA) taxes

- Health insurance premiums

- Retirement contributions

- Any other voluntary deductions

They’ll subtract these deductions from the gross pay to arrive at each employee’s net pay.

Your assistant will create a payslip for each employee that reflects their gross pay, an itemized list of deductions, and their net pay.

The deductions will also be recorded for reference later on, when paying taxes, insurance, and other similar fees.

Double Checking

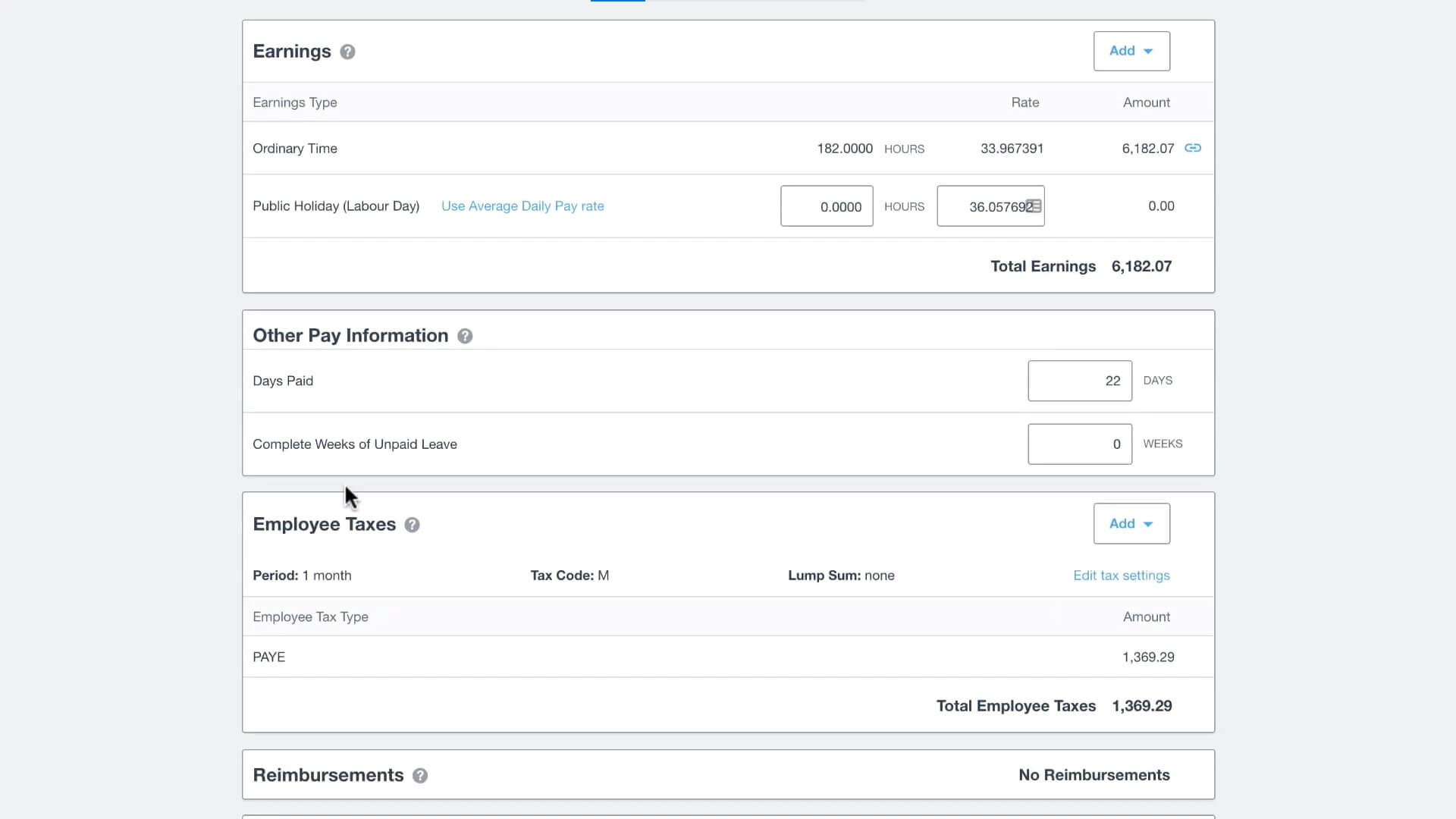

Online payroll tools automatically calculate net pay based on time logged and hourly rates.

If you’re using one of these tools, your assistant just has to double check that your employees’ and contractors’ hours are in order, and that other adjustments have been properly accounted for.

Issuing Payouts

Once net pay has been calculated, your assistant can initiate a pay run.

Making Payments

Your assistant can make payments using the payment channels set up for each employee and contractor.

Direct deposits are the most common, and your assistant can make direct deposits using an online payroll tool or by online banking.

Your assistant can also facilitate payments by e-wallet or other payment methods, such as Stripe or Paypal, which may be more convenient for paying contractors.

Your assistant can use direct deposits or other payment tools to pay employees and contractors. Either link them to a payroll tool, or give your assistant direct access to them.

(Image from Quickbooks)

Sending Payslips

Your assistant will also email your employees’ payslips when sending their pay. This will list gross pay, taxes and other deductions, time adjustments, and any other relevant information.

Online accounting tools send these out automatically during a pay run, but your assistant can also email them manually. You can delegate your Gmail to your assistant if you want them to send these through your account.

Online payroll tools automatically generate payslips, which your assistant can edit as needed.

(Image from Xero)

Taxes and Deductions

Your assistant can also pay taxes and other deductions such as insurance. If you’re delegating this to your assistant, give them access to the proper payment channel and make sure they understand the tax laws that apply to your business.

Updating Payroll Records

Once the pay run is complete, your assistant can update your records and compile updates in a payroll report.

Payroll Report

A payroll report contains:

- Summary of total wages paid

- Breakdown of regular and overtime hours

- Gross pay for each employee

- Itemized deductions and withholdings

- Net pay for each employee

- Total employer taxes and contributions

- Department or cost center allocation

- Year-to-date totals for wages, taxes, and deductions

Your assistant can send these according to your pay schedule (biweekly, semimonthly, monthly etc.), or can send summaries according to a schedule you choose.

With regular updates to your payroll records, and regular reports, it will be easier for you to trace the flow of your business’ funds and to prepare documents for taxes and other reporting purposes.