Bookkeeping for small business ventures can be tedious. It involves reading reams of data, creating reports, and making sure that things are accurate and up to date. Mistakes can put your business in big trouble so you have to stay on top of your finances.

Setting up sound financial management is vital to your success. A bookkeeping virtual assistant will take the pains out of managing small business finances. They take on day-to-day bookkeeping tasks so you can focus on business growth that your company finances can support.

What Is Bookkeeping?

Bookkeeping is the process of logging all the financial affairs of a business into organized accounts daily. Bookkeepers put together financial reports and statements. These are then used by the business owner to conduct sound financial management.

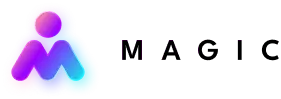

8 Bookkeeping Tips for Small Business Owners

Bookkeeping deals with the fiscal affairs of a business in the past. This informs what can be done in the future, especially for business growth. Stay on top of your finances with these eight tips on bookkeeping for small business owners:

1. Choose a bookkeeping system

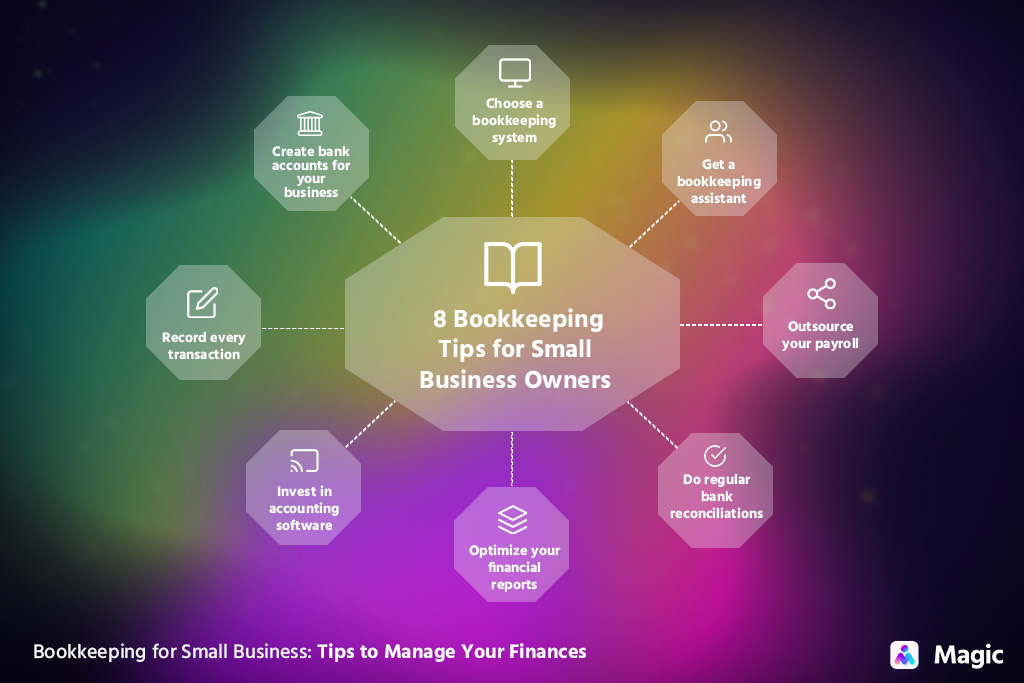

First, you must decide which bookkeeping method you’ll use. Pick the one that better matches your workflow and business size. There are two widely used systems:

- Cash accounting

- It is a cash flow-based system where all of your cash dealings are recorded. A business records its revenue when payments from clients are received. Expenses are also recorded when it pays external entities such as suppliers.In this system, accounts receivable and accounts payable aren’t included until the cash transaction occurs. This is commonly used by small business owners and sole proprietors.

- Accrual accounting

- With this method, transactions are logged before a business receives or dispenses cash (i.e. accounts receivable and accounts payable). This provides you with a comprehensive view of your finances. The system is commonly used by publicly traded businesses or any large firm.

2. Create bank accounts for your business

Regardless of which bookkeeping system you choose, you will still need to make your business accounts separate from your personal ones. Your bookkeeping process will be simpler with no other data to sort through.

An account, in this case, consists of dealings of a certain type. Below are five basic types of accounts:

- Asset accounts – tangible and intangible resources your business owns (e.g. vehicles, equipment, property, copyright, logo)

- Expense accounts – costs made by your business for operations (e.g. payroll, insurance, facility costs, marketing costs)

- Income accounts – money earned from products or services sold

- Liability accounts – costs your business incurs but have not paid yet (e.g. credit memo liability, accounts payable, payroll tax liability, monthly rent payments)

- Equity accounts – remaining value after deducting total liabilities (e.g. stock shares, retained earning)

3. Record every transaction

Some expenses may be more difficult to forecast than others, so tracking them will help you plan for the unexpected. These may include your supplies, insurance, and utilities. Keep an eye on your account receivables and their due dates to prevent your cash flow from drying up.

Back then, bookkeeping for small business ventures meant manually writing business transactions down in a cash book or spreadsheet. Today, you can transfer your sales data to your books much easier using accounting software.

If you have frequent dealings, most accounting software can automate your invoices and set up recurring payments.

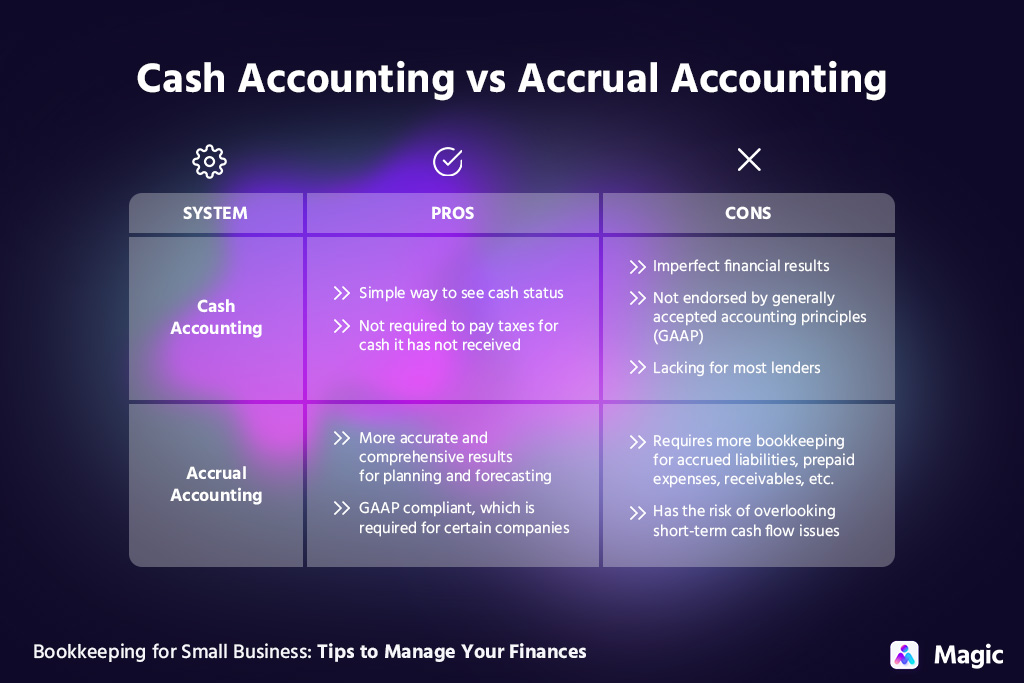

4. Invest in accounting software

There are many types of accounting software with varied features. Small business bookkeeping may not need one that has extensive tools. But as the business grows, it may require custom accounting software to support more complex bookkeeping demands.

Accounting software provides organized records, quick and accurate calculations, and even automation. This makes bookkeeping easier and more accessible for small businesses.

Here are the top accounting software that small businesses can choose from:

5. Optimize your financial reports

Bookkeeping for small businesses doesn’t stop at data collection and data entry. You have to create high-level analyses of the books you’ve balanced through reports. The most common ones in bookkeeping are:

- Balance sheets

- It provides a summary of your business’s liabilities, assets, and equity at a certain point in time. Through this, you can have a quick view of your fiscal health at that time. A strong balance sheet also attracts lenders and backers to your business.

PRO TIP: To strengthen your balance sheet, maintain a good debt-to-equity ratio. The less debt and more cash your business has, the lower the risks are for shareholders.

- Cash flow statements

- It shows where your cash comes from as well as where it goes. On top of that, it can show you whether you are losing more money or gaining more to scale up.A cash flow statement is different from the first two that were discussed. It does not take into account the projected incoming and outgoing cash.

PRO TIP: You can create separate cash flow statements for certain activities. For instance, one is for investing, while the other is for your operations. This allows you to have a complete view of your cash flow.

6. Do regular bank reconciliations

Bank reconciliation is done to check the cash records of a business. Its goal is to look for discrepancies such as overdraft fees and bounced checks. With this, it’s ideal to do them more often to detect and correct errors sooner.

To do so, you cross-check your balances with the data on your bank statements. This includes all the transactions in that bank account during a certain period. You can speed up the process by using accounting software that offers this feature.

As a small business owner, you must do this process at least once at the end of each month. How often you do it depends on the volume of transactions of your business. You might do this process weekly or monthly.

7. Outsource your payroll

As your business grows, running payroll can become a long and stressful process. You also have to comply with several legal requirements which, if not done correctly, could mean serious risks to your business.

One solution to that is to outsource your payroll. There are many payroll providers with varied faculty that can be grouped broadly into two, namely:

- Full-service payroll providers

- The scope of their responsibilities covers everything from start to finish. This includes printing of checks, direct depositing, payroll processing, tax filing, and tax payments. This type of service costs more but gets the majority of the work done efficiently.

- DIY payroll providers

- They are payroll providers that offer online software options you can customize. This type of service is ideal if you just need certain parts of your payroll process outsourced. They can also provide you with the tools you need to do payroll yourself.

8. Get a bookkeeping assistant

It may be daunting for small business owners to manage their finances on top of their core duties. By hiring a bookkeeping virtual assistant, you can delegate these tasks to ensure that your books are properly looked after.

Outsourced bookkeeping for small business growth. Magic can match you with a bookkeeping assistant to manage your accounts. If you’re not sure which task to delegate check out our bookkeeping services list you can outsource today.

The Role of Bookkeeping in Financial Management

Financial management refers to the planning, organizing, and allotting of funds for a business. Basic financial management for a small business concerns proper control of the daily operations of the firm. It also requires staying within budget.

If bookkeeping for small business ventures concerns past affairs, finance management goes into its future. Bookkeeping provides insight into making business recommendations in regard to your company finances. Such information may come as financial records and statements.

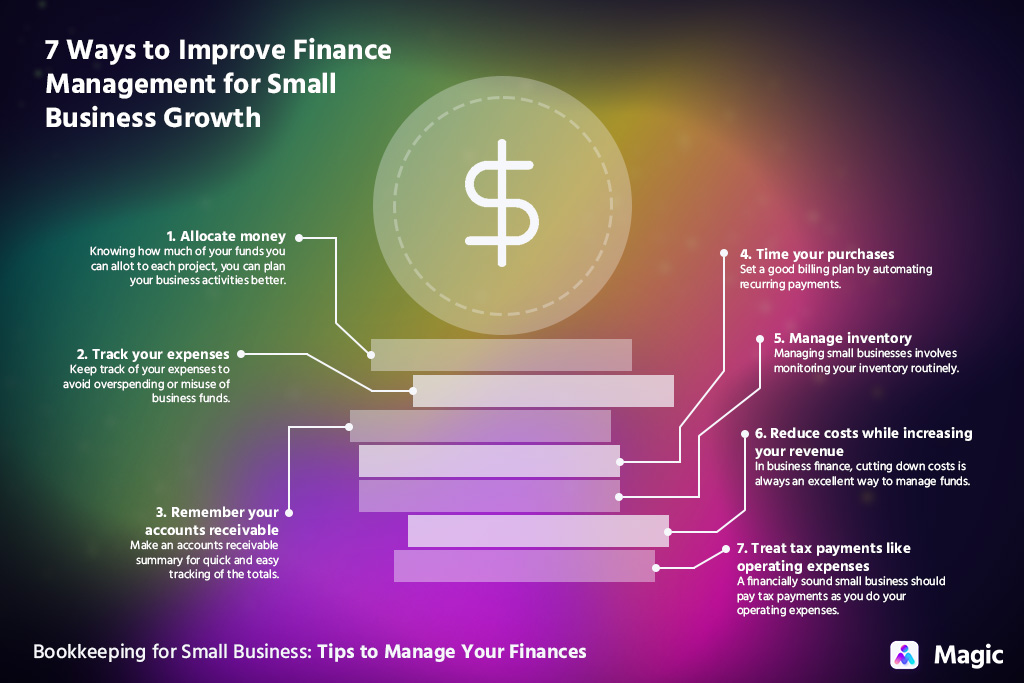

7 Ways to Improve Finance Management for Small Business Growth

A financially sound small business involves having enough funds to support daily operations and foster growth. Your bookkeeping virtual assistant may also help with the finance management of your business.

Here are seven tips for managing small business finances you can follow:

1. Allocate money

Your bookkeeping assistant can help you record your capital, estimated spending, and income projections. Since you know how much of your funds you can allot to each project, you can plan your business activities better.

Budgets can serve as one of your guides in setting and reaching business goals, especially for finance. With it, you can also have an idea of how much cash can be used for other assets or future projects.

Also, make sure that all bills are paid promptly to avoid surcharges and other fees. Your VA can help create lists for recurring expenses and one-time payment purchases. Here are some costs that they’ll need to keep track of:

- Payroll

- Inventory purchases

- Utilities

- Payments on debts

- Insurance premiums

2. Track your expenses

Keep track of your expenses to avoid overspending or misuse of business funds. Having someone keep your books up to date makes it easier to check on them.

A bookkeeping assistant can record all your expenses in your books to get summaries of your expenses. This is so you can gauge if you’re using more than the allotted budget for a certain period or project.

Ask your VA to warn you of any irregular expenses before they are placed on your business debit or credit cards. This also includes uncashed checks, overdraft fees, and overdrawn accounts. This way, you can confirm if these are necessary or not.

Accounting software can streamline the process, while making the data available on the go, too. It makes it convenient, especially if you’re always traveling or if your business has a remote work setup.

3. Remember your accounts receivable

Small business operations may approve credit to clients, especially if for large deals or clients with good standing.

Have your bookkeeping assistant record them in your books and set reminders of their due dates. They can also do payment reminders or follow-ups. Then, you can collect accounts receivables promptly.

Get your VA to make an accounts receivable summary for quick and easy tracking of the totals. This will give you a list of the names of customers who owe money to your company. It also includes the amount due, the due dates of collectibles, and the total of all receivables.

Make sure to collect payments by letting your VA send late notices and invoices to your clients. To prompt early payments, you can also offer a discount for early settlements.

4. Time your purchases

Set a good billing plan by automating recurring payments. Also, ask your bookkeeping virtual assistant to check for ideal times to purchase. Limit low cash flows by making sure that your VA pays your bills first. They can give you a signal when there are enough funds for new assets.

Knowing the optimum time to make purchases can significantly reduce costs. A good bookkeeping VA can also give you a heads-up if there are ways to lessen your tax liability.

5. Manage inventory

Managing small businesses involves monitoring your inventory routinely. Ask your bookkeeping assistant to list your supplies. They can also classify which items to buy more of, and which to buy fewer of.

This keeps you from running out of inventory, especially if a shortage means turning away clients. Plus, you can avoid buying unnecessary things that will just collect dust in your storage.

6. Reduce costs while increasing your revenue

In business finance, cutting down costs is always an excellent way to manage funds. Combining this with active revenue growth allows you to have more profit or more funds for other projects.

To see how you can reduce costs and increase income, ask your bookkeeping assistant to update your income and expense summaries. These summaries will show you what expenses you can scale down or remove.

You can also ask your virtual bookkeeper to find other cheaper or better offers to replace high-cost services. To drive income, your VA will help in sales by offering promos and discounts through phone calls or emails.

7. Treat tax payments like operating expenses

A financially sound small business should pay tax payments as you do your operating expenses. However, it can be challenging to save for tax payments.

If this is the case for your business, spread your taxes every month. Ask your bookkeeping assistant to include it in the monthly payments so it will be lighter for your business. In the end, you’ve settled all tax payments without having to worry about saving up enough funds.

Magic: Hire a Bookkeeping Virtual Assistant with Ease!

With Magic, you can hire a virtual assistant for bookkeeping services and, by extension, finance management. We’ll handle the entire hiring process to keep you from any hassles!

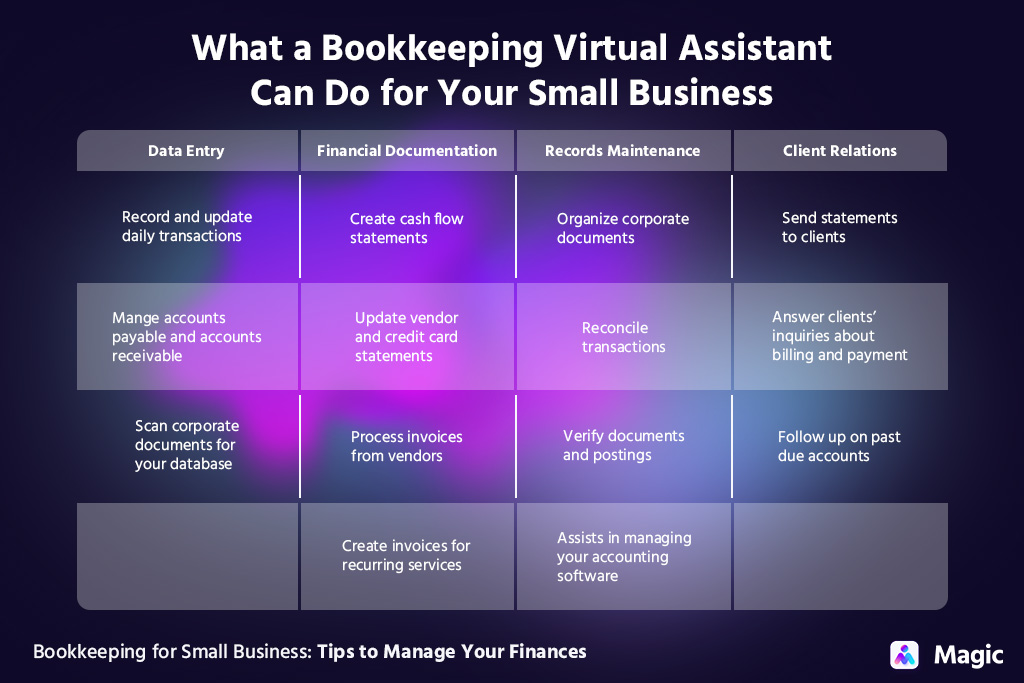

A bookkeeping virtual assistant will take on the following tasks for your business:

Bookkeeping for small business owners doesn’t have to be taxing. Book a call with us to match you with the right Magic Virtual Assistant for your needs. Check out our hiring guide for more details on how we can help grow your business!